“Ethereum, Cosmos, Solana– they all hold something in common: they launched in a bear market, when all was quiet in crypto and only the most committed remained.

As a result, they were able to accrue a valuable community that sustains them to this day, and that community was able to permissionlessly get ownership of the network’s native asset at life-changing prices. So ingrained are these networks to their contributors’ identity, many may never leave.”

— Chris Burniske, haole surfer

The right time for serious projects

Long-term projects have a lot to gain by launching in a bear market. We looked into these above examples and teased out a silver lining (of white gold):

Core supporters

During a bear market, the fly-by-night teams have flown, and what is left is the people who really believe or who really enjoy. These people build the core around which the rest of the DAO’s culture will form, and doing it in this environment ensures a purity of intention that you cannot replicate in a bull market. We saw this in UMA’s original community on Slack, if you can believe it — We had a core group of nerds who are still around today, and helped set the tone for the culture and ethic of the UMA DAO.

Fundamentals Driven

Due to the lack of pump-and-dump opportunities in a down market, the token prices of projects that launch have an opportunity to climb more steadily, in line with product adoption. As a result, the people who accumulate tokens are the kinds who are building a long-term portfolio and will lay the groundwork for a healthy token ecosystem in the next up market.

Legitimacy

For the same reasons that fly-by-night traders are gone, fly-by-night projects are far less likely to launch in a bear. When the market heats up again, projects that have been building all along have a priceless credibility to them. Look at ETHLend, who built all during the bear market, and then re-branded to Aave.

Loyalty

Loyalty to a project can go far deeper than the transient financial incentives. If you launch a project in a down market to only serious supporters, you can feel confident that they are in it for the right ideological reasons, which can’t be shaken regardless of market conditions. Loyalty is so valuable to a protocol because DAO members build up institutional knowledge just like team members do.

Integrations

Quality integrations are easier in a down market when things are quieter and people have time to work together.

Complimentary Tokenomics Strategies

Incentive design can be used artfully to lean into existing themes. Here is what we came up with:

Reward Locking

Across has a liquidity incentive program for assets it supports. Instead of giving everyone the same rate, the team built the Accelerating Distributor (audit), an open-source contract that lets any project increase the rewards rate paid out to loyal liquidity providers. The loyalty meter caps out at 100 days, at which point the LP is earning 300% of what a new depositor is earning.

The meme behind reward locking is $ACX #lockedandlong, and it will play a part in a larger community program that will reward a variety of loyalty-signaling actions.

Auto-staked Airdrop

Behavioral economic researchers have discovered that people will inordinately choose the default option placed in front of them. This is called the status-quo bias. In the case of Across’ airdrop, we could either decide for the default to be “in your wallet” or “staked and earning.” We choose the latter, so when you claim your airdrop, it will automatically be pooled and staked. Your rewards will begin ticking up, and your loyalty multiplier will begin incrementing.

Airdrop claimers do not lose any freedom of choice, they just have a different starting point to encourage coordination.

Targeted Airdrop

The community is the reason Across has overtaken its early competitors, and they are also the earners of the airdrop. Every future $ACX token holder on the list has demonstrated a lasting commitment to Across, and has an incentive to continue to demonstrate it. By putting the tokens in these hands, we can ensure a healthy token ecosystem to embrace the bridge.

A Bridge that Holds

Across is building the bridge that Ethereum deserves. The Across protocol will exist forever on the Ethereum blockchain. Across deserves a similarly long-term community.

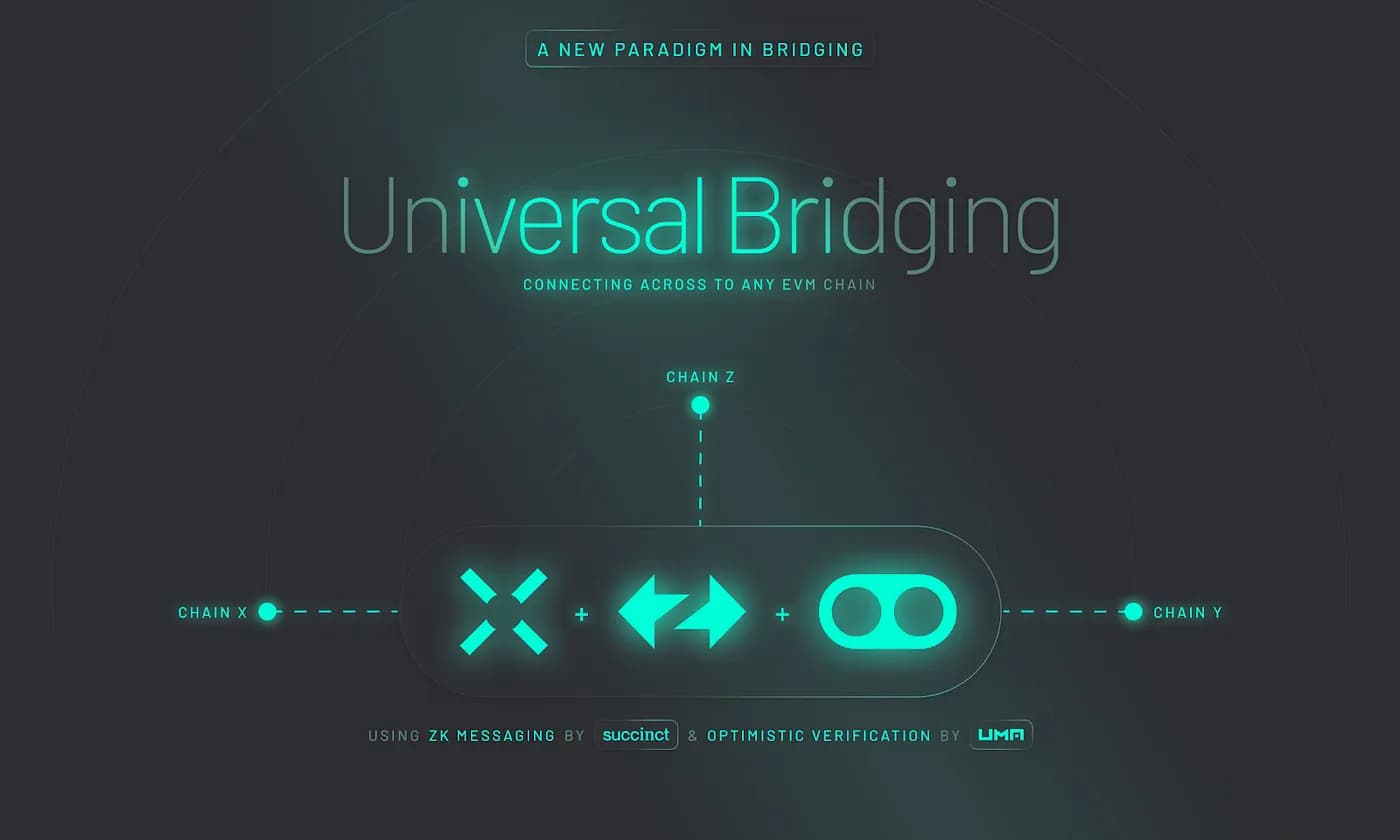

Across Protocol is an intents-based interoperability protocol, capable of filling and settling cross-chain intents. It is made up of the Across Bridge, a powerfully efficient cross-chain transfer tool for end users, Across+, a chain abstraction tool that utilizes cross-chain bridge hooks to fulfill user intents and Across Settlement, a settlement layer for all cross-chain intent order flow. As the multichain economy continues to evolve, intents-based settlement is the key to solving interoperability and Across is at the core of its execution.